Loading

Get Pr Sc 2916 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR SC 2916 online

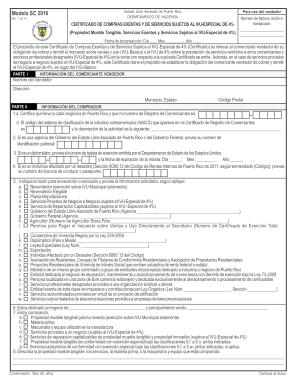

The PR SC 2916 is a certificate used in Puerto Rico for documenting exempt purchases and services subject to a special sales tax. This guide provides clear, step-by-step instructions for filling out this form online, ensuring users can navigate the process effectively.

Follow the steps to fill out the PR SC 2916 online.

- Click 'Get Form' button to access the PR SC 2916 and open it in your preferred online editor.

- In Part I, provide seller information including the vendor's name, address, municipality, and state. Ensure that all details are accurate to avoid any issues.

- Still in Part I, complete the postal code field to confirm the seller's location.

- In Part II, begin by certifying your business status in Puerto Rico. Input your merchant registration number and the corresponding NAICS code.

- If you represent a governmental agency, fill in your employer identification number. For diplomats, include the exemption card number and expiration date.

- For individuals affected by a disaster, provide your driver's license or passport number as requested.

- Select the appropriate reason for exemption by checking the corresponding box and providing the required information if necessary.

- Describe the tangible personal property and services being purchased, providing sufficient details to substantiate your claims.

- In the certification section of Part III, affirm that all information provided is accurate and complete. Sign and date the form.

- After completing the form, save any changes, then download it for your records. You may choose to print or share it as needed.

Complete your documents online to ensure efficient processing and accuracy.

Yes, a real estate license is necessary to sell properties in Puerto Rico. This license ensures that agents are educated about local laws and market practices, protecting both buyers and sellers. Make sure to review PR SC 2916 for specific licensing requirements and processes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.