Get Ca Cdtfa-401-a (formerly Boe-401-a2) 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA CDTFA-401-A (Formerly BOE-401-A2) online

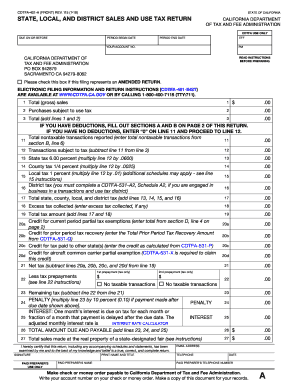

Filling out the CA CDTFA-401-A form online can be a straightforward process if approached step-by-step. This guide presents clear instructions to help users navigate the form effectively, ensuring compliance with California's sales and use tax requirements.

Follow the steps to complete the CA CDTFA-401-A form online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your account number in the specified field to ensure your return is accurately linked to your tax records.

- Indicate the reporting period by entering the period begin date and period end date in the designated areas.

- Fill in the total (gross) sales and purchases subject to use tax on lines 1 and 2 respectively.

- Total the amounts on lines 1 and 2 and enter the sum on line 3.

- If you have deductions to report, complete Sections A and B on page 2 of the return as instructed.

- After calculating your deductions, enter the total nontaxable transactions on line 11 and the transactions subject to tax on line 12.

- Calculate the state tax by multiplying the amount on line 12 by 6.00% and enter it on line 13.

- Continue to calculate the county, local, and district taxes as indicated, entering the total on line 17.

- If applicable, add any excess tax collected on line 18, and then total the tax amounts due on line 19.

- Complete any available credits, subtract them from line 19 to find the net tax due on line 21.

- If there are penalties or interest due, fill these amounts in lines 23 and 24 respectively.

- Finally, review all entered information for accuracy. Save your changes, and choose to download, print, or share the form according to your preference.

Complete your CA CDTFA-401-A form online today to ensure your compliance with California tax regulations.

To verify a California resale certificate, you can use the services provided by the CDTFA. The CA CDTFA-401-A (Formerly BOE-401-A2) offers guidelines on how to authenticate resale certificates for sales tax purposes. Additionally, consider using platforms like UsLegalForms, where you can find templates and tools to assist with the verification process easily. This ensures you're compliant and avoids any potential issues.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.