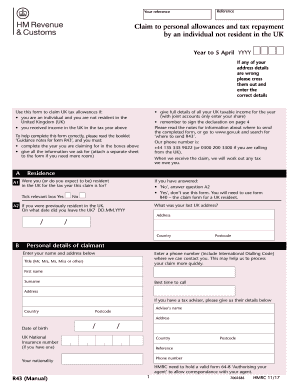

Get Uk Hmrc R43 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign UK HMRC R43 online

How to fill out and sign UK HMRC R43 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Are you still seeking a quick and efficient tool to complete UK HMRC R43 at a fair cost?

Our platform offers a vast library of templates ready for online completion. It only takes a few moments.

Submitting UK HMRC R43 no longer has to be a hassle. Now you can manage it easily from home or your workplace right from your mobile device or computer.

- Select the template you require from our collection.

- Access the template in our online editor.

- Review the instructions to identify the information you need to provide.

- Choose the fillable fields and input the necessary data.

- Include the date and affix your e-signature once you have filled in all boxes.

- Thoroughly review the finished document for typos and other errors.

- If you need to correct any information, the online editing tool and its comprehensive features are available for your assistance.

- Download the completed document to your computer by clicking on Done.

How to modify Get UK HMRC R43 2017: personalize documents online

Put the right documentation management features at your fingertips. Finalize Get UK HMRC R43 2017 with our reliable service that includes editing and electronic signature capabilities.

If you wish to execute and validate Get UK HMRC R43 2017 online without any hassle, then our online cloud-based solution is the perfect choice. We offer a comprehensive template-based catalog of ready-to-utilize documents you can adjust and complete online. Furthermore, you don't have to print the form or rely on third-party services to make it fillable. All necessary tools will be immediately accessible as soon as you open the file in the editor.

Let’s explore our online editing features and their essential functionalities. The editor boasts a user-friendly interface, so it won't take long to learn how to navigate it. We will examine three primary components that enable you to:

In addition to the functionalities outlined above, you can secure your document with a password, add a watermark, convert the file to the desired format, and much more.

Our editor simplifies the process of completing and certifying the Get UK HMRC R43 2017. It allows you to handle virtually everything related to form management. Moreover, we ensure that your experience editing documents is secure and adheres to major regulatory standards. All of these factors enhance the usability of our solution.

Obtain Get UK HMRC R43 2017, make the required adjustments and alterations, and download it in your chosen file format. Experience it today!

- Modify and annotate the template

- The upper toolbar includes tools that assist you in emphasizing and obscuring text, without graphical images (lines, arrows, and checkmarks, etc.), add your signature, initialize, date the document, and more.

- Organize your documents

- Utilize the toolbar on the left if you wish to rearrange the document or remove pages.

- Prepare them for distribution

- If you want to make the template fillable for others and share it, you can utilize the tools on the right and insert various fillable fields, signature and date, text box, etc.

Get form

To contact the UK tax office from abroad, you can call their international helpline or send an email using the contact information available on their website. Ensure that you have your National Insurance number and other relevant details handy for quicker assistance. If you require assistance with your inquiry, uslegalforms can help you navigate this process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.