Loading

Get Ke Form I.t.1 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KE Form I.T.1 online

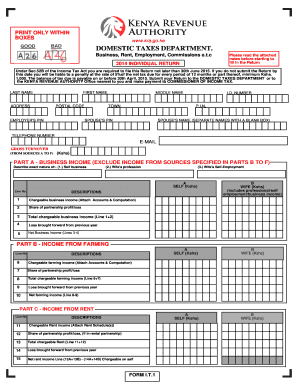

Filling out the KE Form I.T.1 online is a crucial step in fulfilling your tax obligations. This guide will provide detailed and supportive instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully fill out the KE Form I.T.1 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Section A, where you will enter your personal details. Include your first name, middle name, last name, address, postal code, I.D. number, P.I.N., and spouse's details, if applicable.

- Proceed to Part A, focusing on your business income. Here, detail the nature of your business, including income from self and your partner, ensuring to attach supporting accounts and computations.

- Continue to Part B, which pertains to income from farming. Document your gross farming income and any applicable partnerships, along with necessary attachments.

- In Part C, provide details on your income from rent. Ensure to include all rental income along with any partnership share of profit or loss.

- Move to Part D for interest income, documenting both your own and your partner's income with the required schedules.

- In Part E, complete the section regarding insurance commission, detailing both your and your partner's chargeable income, including necessary attachments.

- Part F covers other income not categorized in previous sections. Specify the nature of this income, and include any partnership details.

- Proceed to Part G to document employment income. Include gross pay, benefits, and other relevant details for both you and your partner.

- In Part H, calculate and state total taxable income based on previous sections, adjusting for any pension contributions or mortgage interest.

- Part I is for tax computation. You will need to determine tax payable for both yourself and your partner, applying applicable reliefs.

- Move on to Part J to calculate final tax amounts and potential refunds due.

- In Part K, provide details of payments, penalties, and ensure all figures are accurately calculated to reflect totals.

- Fill out Parts L, M, N, as necessary, detailing employment, partnerships, and landlord information.

- Finally, complete Part P, ensuring you sign and declare the document accurately. Provide your bank details for potential refunds.

- Once all sections are completed, review the document for accuracy. Save your changes, then download, print, or share the form as necessary.

Take action now and complete your KE Form I.T.1 online to ensure timely submission of your tax return.

No, the 1040EZ form no longer exists as it has been integrated into the revised 1040 form. This change reflects the IRS's efforts to streamline tax filing processes. If you require assistance with your tax forms, including the KE Form I.T.1, platforms like uslegalforms offer useful resources to facilitate your filing experience.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.