Loading

Get Canada Ct23 2007-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada CT23 online

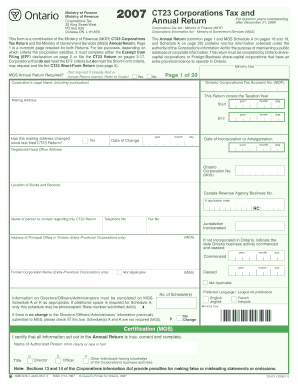

The Canada CT23 form is essential for corporations in Ontario to report their tax information accurately. This guide will provide you with a step-by-step approach to effectively completing the form online, ensuring all necessary details are adequately captured.

Follow the steps to complete the Canada CT23 online.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the corporation's legal name, ensuring accuracy and proper punctuation to avoid any discrepancies.

- Provide the Ontario Corporations Tax Account number, which is crucial for identifying your corporation in the tax system.

- Fill in the mailing address of the corporation, including any changes since the last submission. If there have been changes, mark the relevant box.

- Indicate the dates, including the date of incorporation or amalgamation, making sure to use the correct format (year-month-day).

- For corporations claiming exemption from filing, complete the Exempt from Filing (EFF) declaration on page 2, ensuring all criteria are thoroughly met.

- Continue to the section for the CT23 Corporations Tax Return. Indicate the type of corporation and provide any relevant information related to its fiscal year.

- Report the net income for Ontario purposes, making sure to subtract any allowable deductions as specified in the form instructions.

- Complete sections related to tax credits, ensuring you include all relevant details and attachments as necessary.

- After filling out all required sections, save your changes. You may then download, print, or share the form as appropriate.

Complete your Canada CT23 form online today to ensure timely and accurate reporting.

Related links form

To get an EOI, start by gathering all necessary documentation and ensure you meet the eligibility criteria set by the Canadian immigration system. Next, complete your profile in the Express Entry system or other relevant platforms. Utilizing resources like US Legal Forms can provide you with the necessary templates and guidance for submitting your EOI for Canada CT23 smoothly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.