Loading

Get Canada At1 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada AT1 online

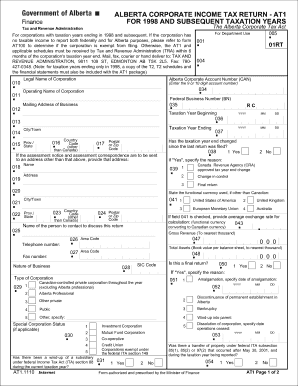

The Canada AT1 form is essential for corporations operating within Alberta, enabling them to report their income tax for taxation years ending in 1998 and subsequent years. This guide will provide step-by-step instructions to help users complete the form accurately and effectively online.

Follow the steps to fill out the form correctly.

- Press the ‘Get Form’ button to access the Canada AT1 form online.

- Fill in the legal name of the corporation in the designated field. Ensure that the name is consistent with the entity's registration documents.

- Enter the federal business number (BN) in the specified area. If your corporation does not have a BN, you should seek guidance on obtaining one.

- Provide the mailing address for the business, including the street address, city, province or state, and postal or zip code.

- Indicate the taxation year start and end dates. This is critical for determining the period for which you are reporting.

- Answer whether there has been a change in the taxation year end since the last return. If yes, provide the reason for this change.

- Specify the nature of your business by entering the SIC code, if applicable, ensuring you select the most accurate description.

- If this is a final return, indicate this in the corresponding section and provide a reason if necessary.

- Report the gross revenue and total assets, rounding to the nearest thousand. Ensure that you report all monetary amounts in dollars without cents.

- Complete the sections related to Alberta taxable income and other deductions, cross-referencing the appropriate schedules as required.

- After filling all sections, ensure you review your entries for accuracy and completeness. It is vital for efficient processing.

- Finally, save your changes and options will be presented to download, print, or share the form as needed.

Start completing your AT1 form online today to ensure timely submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

A corporation can typically amend a tax return up to three years from the original filing date. This timeframe allows you to correct any mistakes, ensuring your financial records are accurate and compliant. Be proactive in addressing issues to avoid complications with the Canada Revenue Agency. For detailed guidance, consider the resources provided by uslegalforms.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.