Loading

Get Canada Sa 108 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada SA 108 online

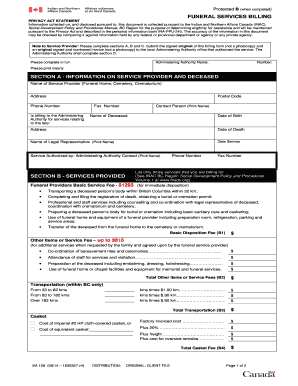

The Canada SA 108 form is essential for funeral service providers to bill for services provided to the deceased and their families. This guide offers clear steps to effectively fill out the form online, ensuring that all necessary information is accurately provided.

Follow the steps to complete the Canada SA 108 form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Fill in Section A with the information about the service provider and the deceased. Include the name, address, phone number of the service provider, and the deceased's name and date of birth.

- In Section C, list any additional items or services purchased by other parties, noting that these are not covered by the administering authority.

- Finalize by completing Section D, which requires authorization from the administering authority. This section should be reviewed and approved by them.

- Once all sections are completed, save your changes. You can then download, print, or share the form as needed.

Complete your forms online today for a seamless experience.

To declare foreign pension income in Canada, include the income on your annual tax return. It’s essential to convert the income from foreign currency to Canadian dollars using the appropriate exchange rate. Use Canada SA 108 to ensure accurate declaration. Our platform can help clarify the reporting process and ensure compliance with Canadian tax laws.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.