Loading

Get Form 590

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 590 online

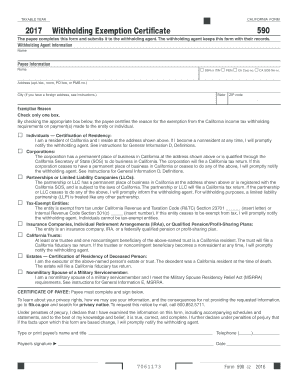

Filling out Form 590, the Withholding Exemption Certificate, is an essential step for individuals and organizations seeking to certify their exemption from California income tax withholding. This guide will provide clear, step-by-step instructions to assist you in completing the form accurately online.

Follow the steps to fill out Form 590 online:

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the withholding agent's information which includes their name and address. Ensure all details are accurate, as this information is essential for proper record-keeping.

- Next, provide your information as the payee. Fill in your name and select the appropriate Taxpayer Identification Number (TIN) from the options provided: Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), Federal Employer Identification Number (FEIN), California Corporation number, or Secretary of State file number.

- Fill in the address fields with your complete address, including city, state, and ZIP code. If you have a foreign address, be sure to follow the specific instructions for foreign addresses.

- Indicate your exemption reason by checking one of the available boxes that best describes your status. Each option includes a certification statement relevant to your exemption from withholding requirements.

- Sign and date the Certificate of Payee section at the bottom of the form. Ensure you print your name and title clearly, as well as provide your contact telephone number.

- After completing the form, you can save your changes, download a copy for your records, and print it if necessary. Share the completed form with the withholding agent as required.

Complete your Form 590 online to ensure your withholding exemption is processed smoothly.

Why you received IRS Letter 590 The IRS selected your tax return for an audit. After the audit, the IRS did not propose any changes to your tax return. The IRS sent you this letter to inform you that no changes were made.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.