Loading

Get Common Reporting Standard (crs) Entity Self Certification

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Common Reporting Standard (CRS) Entity Self Certification online

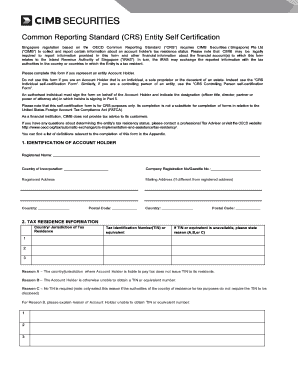

The Common Reporting Standard (CRS) Entity Self Certification is a crucial document for entities seeking to comply with international tax reporting regulations. This guide provides users with clear, step-by-step instructions to complete the form online, ensuring all necessary information is accurately provided.

Follow the steps to successfully complete the CRS Entity Self Certification form online.

- Press the ‘Get Form’ button to access the CRS Entity Self Certification form and open it in the editing interface.

- Fill out the 'Identification of Account Holder' section. Provide the registered name of the entity, country of incorporation, and company registration number. Also, include the registered address and, if different, the mailing address along with the respective postal codes.

- Complete the 'Tax Residence Information' section. Indicate the country or jurisdiction of tax residence, and provide the corresponding Tax Identification Number (TIN) or equivalent. If the TIN is unavailable, select a reason from the provided options (A, B, or C) and explain if Reason B is applicable.

- In the 'Entity Type' section, select the correct classification for the entity according to the definitions provided in the appendix.

- If applicable, provide information about any controlling persons in the 'Controlling Person' section. Name any individuals who have control over the entity and ensure that a separate CRS Controlling Person Self Certification form is completed for each controlling person.

- Review the 'Declaration' section. Make sure you understand that the information provided is governed by CIMB's terms and conditions. Certify that you are authorized to sign on behalf of the account holder, and note any obligations regarding changes in circumstances affecting tax residence.

- After completing all sections, users can save changes, download, print, or share the completed form online.

Take the next step towards compliance by completing your CRS Entity Self Certification form online today.

When you open a new bank account for your group, the bank may send you a form called something like “CRS Entity Self-certification form” or “Tax Residency Self-certification Declaration form”. The form may mention something called the Common Reporting Standard or Automatic Exchange of Information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.