Loading

Get Interprovider Plan-to-plan Transfer Request State Of ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the INTERPROVIDER PLAN-TO-PLAN TRANSFER REQUEST online

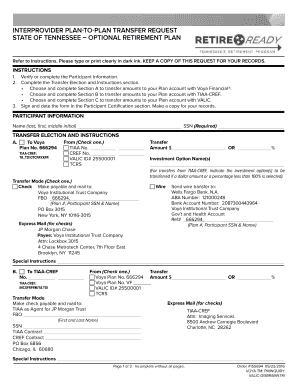

The INTERPROVIDER PLAN-TO-PLAN TRANSFER REQUEST is essential for transferring account balances between investment providers within the State of Tennessee Optional Retirement Plan. This guide will provide you with clear and concise instructions on how to accurately complete the form online.

Follow the steps to fill out your transfer request accurately.

- Press the ‘Get Form’ button to access and open the transfer request form for editing.

- Begin with the Participant Information section. Ensure you fill out your name clearly, including your last name, first name, and middle initial. Include your Social Security Number as it is required.

- Proceed to the Transfer Election and Instructions section. Here, select the appropriate option for your transfer to Voya, TIAA-CREF, or VALIC by completing the corresponding section (A, B, or C).

- In each section (A, B, or C), indicate the transfer mode by checking either 'Check' or 'Wire'. If you select 'Check', complete the mailing address for the receiving provider. If you choose 'Wire', fill in the necessary banking information.

- Specify the amount you wish to transfer in dollars or as a percentage. If transferring from TIAA-CREF, indicate the investment option name if selecting a partial transfer.

- Complete any special instructions if applicable, such as requests for specific handling.

- In the Participant Certification section, print your name, sign, and date the form. This certifies that you understand the details of your transfer request.

- Finally, mail or fax the completed form to both the transferring and receiving investment providers as listed at the end of the document. Ensure that you retain a copy of your request for your records.

Complete your INTERPROVIDER PLAN-TO-PLAN TRANSFER REQUEST online today!

A qualified plan-to-plan transfer is the process of moving money from a qualified (as defined by IRS) pretax investment account/retirement plan to another qualified plan without incurring taxes or penalties on the money being transferred.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.