Loading

Get My Cp39 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MY CP39 online

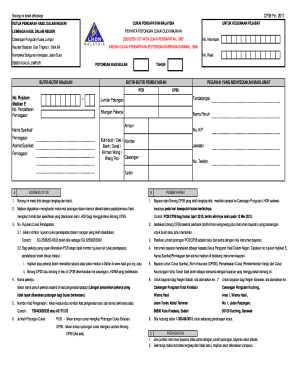

The MY CP39 form is essential for employers in Malaysia to report monthly tax deductions for their employees. This guide provides a clear, user-friendly approach to completing the MY CP39 form online, ensuring accuracy and compliance with Malaysian tax regulations.

Follow the steps to fill out the MY CP39 form effectively.

- Press the ‘Get Form’ button to access the form and open it in the designated online editor.

- Fill in the Tax Reference Number in the specified field. For example, enter PCB/CP38 for the month of April 2010. Use the proper format with no spaces.

- For employees liable for tax deductions without a tax file reference number, prepare the MY CP39 form along with a separate cheque or payment instrument for different months or years.

- Verify that the total PCB/CP38 deductions match the payment instrument amount. Consistency is crucial to avoid payment rejection.

- The payment instrument must be submitted to the Director General of Inland Revenue. Record the Employer Reference Number, and include the company name and address on the payment instrument.

- Payments and the completed MY CP39 form must be delivered to the Tax Collection Branch by the 10th of the following month.

- List the full names of employees as stated in their identification documents, ensuring you do not include those not liable for deductions.

- Enter the total tax deductions for PCB and CP38 as applicable.

- If the payment amount does not correspond with the total deductions, the payment will be rejected.

- For any incomplete or incorrect information, employers risk penalties, so ensure all entries are accurate.

Complete your MY CP39 form online today to ensure compliance and avoid potential penalties.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The meaning of MY CP39 revolves around providing the taxpayer with important updates regarding their tax situation. Specifically, it signifies that something may need your attention to ensure compliance with IRS rules. By understanding the implications of this notice, you can maintain better control over your tax matters.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.