Loading

Get M3 Form

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the M3 Form online

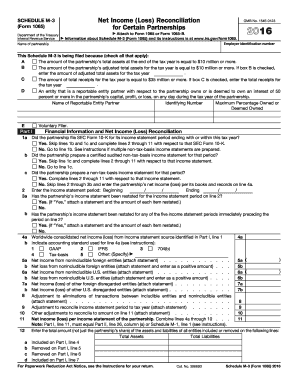

The M3 Form, also known as the Schedule M-3, is essential for partnerships with significant assets and receipts as it reconciles net income and provides a detailed overview of financial data. This guide will walk you through each section of the form to ensure accurate completion when filing online.

Follow the steps to complete the M3 Form comprehensively.

- Click ‘Get Form’ button to obtain the M3 Form and open it in the editor.

- Begin by entering the employer identification number and the name of the partnership at the top of the form.

- Indicate the reason for filing Schedule M-3 by checking all relevant boxes indicating the qualifying conditions such as total asset amounts or reportable entity partner ownership.

- Proceed to Part I where you will provide financial information. Answer the initial questions regarding whether the partnership filed SEC Form 10-K and whether it prepared audited or non-tax-basis income statements.

- Depending on your answers in step 4, complete the applicable lines in Part I to report the partnership's worldwide consolidated net income or loss, indicating the accounting standards used.

- Complete lines for net income or losses from foreign and U.S. disregarded entities, as well as any additional adjustments or reconciliations required.

- Move to Part II to reconcile net income or loss from the income statement with the income or loss reported on the tax return, inputting items and differences as instructed.

- Continue to Part III to finalize reconciliation of expenses and deductions, detailing any temporary or permanent differences.

- Review all sections for accuracy, ensuring every necessary detail has been provided.

- Once completed, save any changes, and proceed to download, print, or share the M3 Form as required.

Complete your documents online now to ensure timely and accurate filing.

JCQ/M1. Suspected candidate malpractice. Confidential. This form is to be used by centres to report instances of suspected candidate malpractice. For guidance on how to complete this form please see page 7.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.