Loading

Get Va Vec-fc 20c 2007-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA VEC-FC 20C online

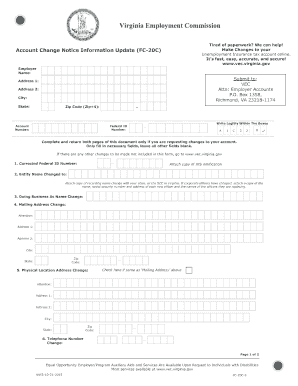

The VA VEC-FC 20C form is a critical document for updating employment information with the Virginia Employment Commission. This guide will provide you with a straightforward approach to accurately completing the form online, ensuring that your changes are processed efficiently.

Follow the steps to complete your VA VEC-FC 20C form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your account information in the designated fields. This includes your account number, account name, and trade name if applicable. Ensure that the mailing address, city, state, and zip code are accurate.

- If your federal ID number is incorrect or missing, input the correct number in the designated section. Remember to attach a copy of the IRS notification for any changes.

- If your corporate name has changed, provide the new corporate name in the appropriate field. If there have been changes to officers, include the name, social security number, and address of each new officer, along with the names of those they are replacing.

- Adjust any other changes such as your trade name, mailing address, physical location, and telephone number as needed in the specified sections.

- Indicate your employment status by checking the appropriate boxes regarding employees or contractors. This includes confirming if you have no employees in Virginia or if contract workers are still present.

- If applicable, specify if your business has been dissolved or if there has been an ownership change. Provide relevant dates and successor information in the provided fields.

- Complete the form by signing it and adding your name, date, and your title or relationship to the business. Ensure all required sections are filled out completely.

- Finally, review all entries for accuracy before saving changes. Once completed, you may save your changes, download, print, or share the form as necessary.

Start completing your VA VEC-FC 20C form online today!

The employer quarterly FC20 21 is a report that Virginia employers must submit to the VEC, detailing wages and employment information. This data helps calculate unemployment taxes. Ensuring accurate submissions is vital to comply with the VA VEC-FC 20C regulations. The Virginia Employment Commission offers guidance for completing these forms correctly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.