Loading

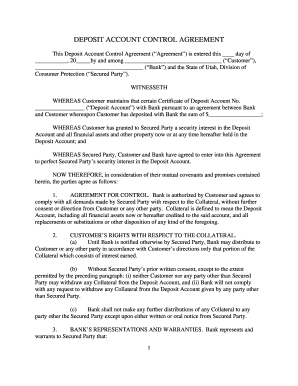

Get Ut Deposit Account Control Agreement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT Deposit Account Control Agreement online

Filling out the UT Deposit Account Control Agreement may seem complex, but this guide is designed to assist you through each step of the process. With clear instructions, you will be able to complete the form online confidently and accurately.

Follow the steps to successfully fill out the agreement online

- Click the ‘Get Form’ button to obtain the document and open it in your editing application.

- Begin by entering the date on which you are completing the agreement in the designated field.

- Fill in the name of the Customer in the appropriate section. This should reflect the individual or entity that holds the Deposit Account.

- Enter the state entity's name as the Secured Party, specifically the State of Utah, Division of Consumer Protection.

- Indicate the total sum deposited in the Deposit Account. Ensure this information is correct to avoid future discrepancies.

- Read through each provision carefully and ensure that you understand them. This includes the rights and responsibilities of each party involved.

- In the signature fields for the Bank and Secured Party, ensure to provide the relevant signatures and titles for authorization.

- Finally, after thoroughly reviewing the document, you can save changes, download it, print the form, or share it as needed.

Complete your documents online with confidence today.

To fill out the authorization agreement for direct deposit, first, gather necessary information such as your bank account number and routing number. Next, complete the form by providing your personal details and any relevant account specifics. Finally, ensure you sign and date the form to authorize the direct deposit, including mentioning the UT Deposit Account Control Agreement if applicable.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.