Get Nv Rpt7833

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NV RPT7833 online

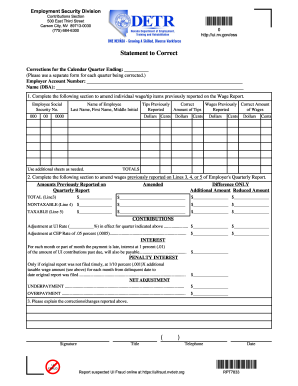

This guide provides clear and step-by-step instructions for filling out the NV RPT7833 form online. Whether you are correcting wage reports or amending contributions, this resource is designed to support users of all experience levels.

Follow the steps to successfully complete the NV RPT7833 online.

- Click the ‘Get Form’ button to access the NV RPT7833 form and open it in the online editor.

- In the section labeled ‘Statement to Correct,’ fill in the calendar quarter that you are correcting. Remember to use a separate form for each quarter.

- Enter your employer account number and your business name, or DBA (doing business as), in the designated fields.

- Locate the section to amend individual wage/tip items. Here, input each employee's Social Security number, name, tips previously reported, and wages previously reported in the required fields.

- If you are amending amounts previously reported on the Employer's Quarterly Report, complete the designated section for Lines 3, 4, and 5 of the report, indicating both amended amounts and any reductions or increases.

- Calculate any adjustments at the UI rate and the CEP rate, entering those amounts in the corresponding fields.

- For late payments, calculate the interest amounts and penalties as required, filling those into the form.

- Finally, explain any corrections or changes you reported in the designated space. Ensure to sign and date the form, and add your title and telephone number.

- Once completed, save your changes, download a copy for your records, print it if needed, or share it as appropriate.

Complete your NV RPT7833 form online today to ensure timely corrections and accurate reporting.

To obtain a Nevada employer account number, you must register your business with the Nevada Department of Employment, Training, and Rehabilitation. The registration process can usually be completed online, ensuring you provide all required information. NV RPT7833 may serve as a valuable tool, providing clear steps on how to navigate this process. With the right support, securing your employer account number becomes straightforward.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.