Loading

Get Tx Aw4-18 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX AW4-18 online

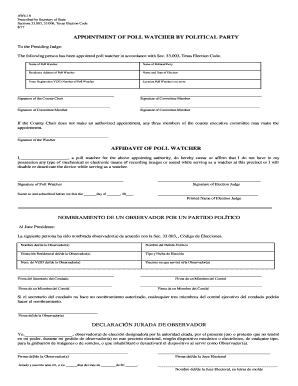

The TX AW4-18 form, known as the Appointment of Poll Watcher by Political Party, is crucial for ensuring proper election monitoring. This guide will provide detailed instructions on how to fill out this form online effectively.

Follow the steps to complete the TX AW4-18 form online.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Enter the name of the poll watcher in the designated field at the top of the form. Ensure that the spelling is accurate.

- Input the name of the political party appointing the poll watcher. This is required for identification purposes.

- Fill in the residence address of the poll watcher. Include street address, city, state, and zip code.

- Indicate the name and date of the election for which the poll watcher is appointed. This helps to contextualize the appointment.

- Provide the Voter Registration Unique Identifier (VUID) number of the poll watcher. This is essential for verifying eligibility.

- Specify the location where the poll watcher is to serve, which must align with the election precinct.

- Obtain the signature of the county chair, along with signatures from three committee members. These signatures validate the appointment.

- The appointed watcher should sign the form to acknowledge their role and responsibilities.

- Complete the affidavit section. Here, the poll watcher must affirm they do not have any device for recording during their service.

- Ensure the election judge and the poll watcher each provide their signatures, along with the printed name of the election judge.

- Review all details entered for accuracy before proceeding. Make necessary corrections if needed.

- Finally, save your changes, and choose whether to download, print, or share the completed form as required.

Start completing your TX AW4-18 form online today.

To fill out a W-4 step by step, start by entering your name and Social Security number. Next, select your filing status, and then determine the number of allowances based on your dependents and situation. After completing these sections, review the information, sign the form, and submit it to your employer. The TX AW4-18 provides a structured framework that guides you through each step effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.