Loading

Get Tx Dob Corp - P04 2012-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX DOB CORP - P04 online

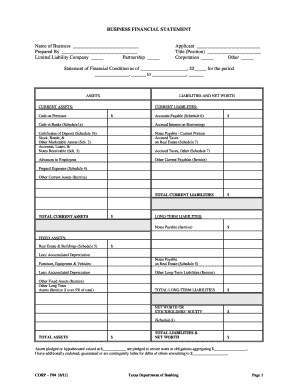

The TX DOB CORP - P04 form is essential for business entities in Texas to provide a comprehensive financial overview. This guide will assist you in filling out the form accurately and efficiently, ensuring all necessary information is captured correctly.

Follow the steps to complete the form successfully.

- Select the ‘Get Form’ button to access the TX DOB CORP - P04 form and open it for editing.

- Begin by entering the name of the business and the individual preparing the financial statement. Indicate the type of business entity by checking the appropriate box, such as 'Limited Liability Company', 'Partnership', 'Corporation', or 'Other'.

- Fill in the applicant's name and their title or position within the business. Ensure accuracy, as this information is critical for identification.

- Complete the 'Statement of Financial Condition' section by inserting the date and the period during which the financial statement is relevant.

- Report all current assets, including cash on premises and in banks. Detail any certificates of deposit, marketable assets, and receivables in the respective sections.

- Document liabilities by listing current liabilities, including accounts payable and accrued taxes. Include all notes payable and other current payables, providing itemized details where necessary.

- Provide information regarding long-term liabilities and specify any fixed assets, including real estate, and their associated values. Include accumulated depreciation.

- Calculate and enter the total values for assets, liabilities, and net worth sections to ensure they align correctly.

- Proceed to the schedules and complete each relevant schedule, such as cash in financial institutions, certificates of deposit, stocks, bonds, and receivables, following the provided fields.

- Complete the statement of income and expenses, detailing both income and expenses for the specified period. Ensure accuracy in net operating income and any other income or expenses.

- Finally, certify the financial report by signing and dating the document. Ensure that your name and title are typed or printed clearly.

- Review the entire document for any errors or omissions. Upon finalization, save your changes, then download, print, or share the filled-out form as needed.

Start completing the TX DOB CORP - P04 form online today for a smooth filing experience.

Related links form

Yes, Texas franchise tax can generally be deducted on your federal tax returns. This deduction can help mitigate your overall tax liability. For clarity on how to handle this deduction, consider the assistance offered through the TX DOB CORP - P04, which can provide detailed insights tailored to your business needs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.