Loading

Get Form 8233

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8233 online

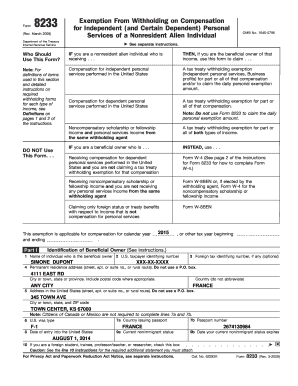

Form 8233 is used by nonresident aliens to claim an exemption from withholding on certain compensation for personal services performed in the United States. This guide provides clear, step-by-step instructions to assist users in completing the form online accurately.

Follow the steps to fill out Form 8233 online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by providing your name as the individual who is the beneficial owner in Part I. Ensure that you use your full legal name.

- Enter your U.S. taxpayer identification number in the next field. If you do not have one, you may leave this field blank.

- If you have a foreign tax identifying number, include it in the optional field provided.

- Fill in your permanent residence address. Include the street address, city or town, and country. Avoid using a P.O. box.

- Provide your address in the United States, including the street address, city, and ZIP code, ensuring no P.O. box is used.

- List your U.S. visa type and any additional details required such as passport information and date of entry.

- In Part II, briefly describe the personal services you are providing, then state the total compensation you expect to receive.

- Indicate the tax treaty and article number if claiming an exemption, alongside any compensation exempt from tax.

- If applicable, enter any amounts related to noncompensatory scholarships or fellowships.

- Complete the certification section in Part III, ensuring that you sign and date the form.

- If you are the withholding agent, complete the acceptance and certification section with the required details.

- Once all fields are completed, review the form for accuracy. Save changes, download a copy, print it, or share it as necessary.

Complete your Form 8233 online today to ensure your tax treaty benefits are claimed accurately.

The payee can claim a treaty exemption that reduces or modifies the taxation of income from dependent personal services, pensions, annuities, social security and other public pensions, or income of artists, athletes, students, trainees, or teachers. This includes taxable scholarship and fellowship grants.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.