Loading

Get Form No. 15cb (see Rule 37bb) Certificate Of An Accountant ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

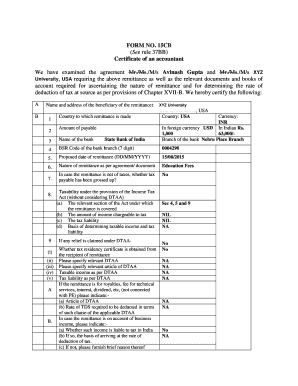

How to fill out the FORM NO. 15CB (See Rule 37BB) Certificate of an Accountant online

Filling out the FORM NO. 15CB is essential for reporting certain remittances for tax purposes. This guide will provide you with a detailed, step-by-step approach to complete the certificate online with ease.

Follow the steps to complete the FORM NO. 15CB accurately.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online document editor.

- Begin with the beneficiary information. Enter the full name and address of the recipient who will receive the remittance.

- Specify the country to which the remittance is being made. For instance, if remittance is to the USA, select or type 'USA'.

- Indicate the amount payable. Select the currency for this transaction, choosing between Indian Rupees (INR) or foreign currency (USD). Enter the exact amount.

- Fill in the name of the bank conducting the transaction. Make sure it’s the correct bank where the account is held.

- Provide the BSR Code for the bank branch, which is a mandatory 7-digit number.

- State the proposed date of remittance in the format DD/MM/YYYY to ensure accuracy.

- Describe the nature of the remittance per the agreement or supporting document. For example, if it is for educational fees, state that clearly.

- If applicable, indicate if the remittance is net of taxes and whether the tax payable has been grossed up. Answer with 'Yes' or 'No' as required.

- Address the taxability under the provisions of the Income Tax Act. Provide details regarding the relevant sections, taxable income amount, tax liability, and the basis of determination.

- If any relief is claimed under the Double Taxation Avoidance Agreement (DTAA), specify whether a tax residency certificate has been obtained from the recipient.

- Complete the final sections that pertain to specific types of income like royalties, technical services, or capital gains by indicating the appropriate details.

- Review all the information entered for accuracy and completeness. Save changes, download, print, or share the filled form as needed.

Begin completing your FORM NO. 15CB online for accurate and efficient reporting.

As per the Section 195 of the Income Tax Act, 1961, read with Rule 37BB of the Income Tax Rules, 1962, every authorized dealer making a payment to a non-resident, not being a company or to a foreign company, is required to furnish statement of such payments Form 15CC.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.