Loading

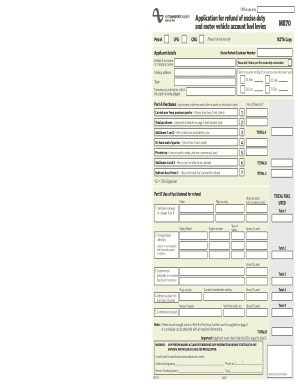

Get Application For Refund Of Excise Duty And Motor Vehicle Account Fuel Levies (mr70). Application For

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Refund Of Excise Duty And Motor Vehicle Account Fuel Levies (MR70) online

This guide provides clear instructions for completing the Application For Refund Of Excise Duty And Motor Vehicle Account Fuel Levies (MR70) online. Follow these steps to ensure your application is filled out accurately and efficiently.

Follow the steps to successfully submit your application.

- Press the ‘Get Form’ button to access the MR70 form and open it in your preferred editor.

- Complete the applicant details section. Include your initials, surname or company name, and mailing address. If this is your first excise duty refund claim, be sure to tick the corresponding box.

- Select the claim period by ticking one of the boxes for the quarter ending, ensuring you also insert the relevant year.

- Fill out Part A for purchases. Indicate the number of litres or Gigajoules purchased during the quarter, including any carried over from the previous quarter.

- Calculate the total purchases and ensure that you add any carried over amounts to determine the total fuel available for use.

- Complete the section on private use, which includes any fuel used on public roads or for non-commercial purposes.

- Once you have calculated the total fuel claimed for refund, make sure that your totals are correctly represented in the final section of Part A.

- Move on to Part B and document the use of the fuel claimed for refund, including details for vehicles licensed in specific classes and any unregistered vehicles.

- If additional space is needed to detail fuel usage, utilize page two of the form or an attached schedule.

- Review all entries for accuracy, particularly ensuring that totals are consistent throughout the form.

- Sign the form, indicating that all provided information is accurate, and include any necessary contact details.

- Keep a photocopy of the completed form for your records, then submit the application along with supporting documentation to the specified address.

- After submission, you may save, download, or print a copy of the application for your reference.

Start your online refund application today and ensure you follow these guidelines for a smooth submission.

Petrol excise duty remains at its current reduced rate of 45.02 cents per litre until 30 June 2023. Reduced road user charges rates have been reintroduced and apply until 30 June 2023. All rates are reduced by 36 percent. You can contact Waka Kotahi with questions about individual rates.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.