Loading

Get Ac3206 (rev - Osc State Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AC3206 (Rev - Osc State Ny online

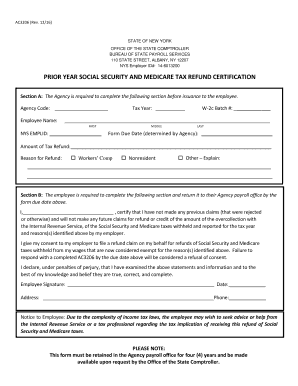

The AC3206 (Rev - Osc State Ny) is a vital form for certifying prior year social security and Medicare tax refunds in New York. This guide will provide you with clear, step-by-step instructions for completing the form accurately and efficiently online.

Follow the steps to complete the AC3206 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Section A, your agency should fill in the Agency Code. Provide the employee's name, tax year, and W-2c Batch number. Ensure to obtain the NYS EMPLID and input the Form Due Date determined by your agency.

- Next, in Section A, indicate the amount of the tax refund. You should also select the reason for the refund. Options include Workers' Comp, Nonresident Alien, or specify another reason, providing an explanation if necessary.

- In Section B, the employee must enter their name. They should then certify that no previous claims for the refund have been made and agree not to file future claims concerning the overcollection indicated above. Ensure all information is true, correct, and complete.

- The employee should sign the form and provide the date of signing, address, and phone number. This validation is crucial for the processing of the form.

- After the form is completed, review all entries for accuracy. Save the changes you made, and then proceed to download, print, or share the form as needed.

Complete your AC3206 form online to ensure accurate processing of your tax refund.

Allow 15 days from your refund issue date to receive your refund. If you don't receive your refund within 15 days, call your bank.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.