Loading

Get R 6950

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the R 6950 online

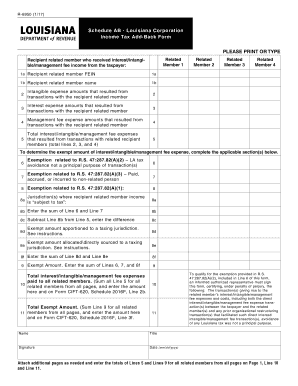

Filling out the R 6950 online is essential for Louisiana corporations to accurately report interest, intangible, and management fee expenses. This guide will walk you through each section of the form, ensuring that it is completed correctly and thoroughly.

Follow the steps to fill out the R 6950 online efficiently.

- Click ‘Get Form’ button to access the R 6950 online and open the document in your preferred web browser.

- In the ‘Related Member 1’ section, enter the Federal Employer Identification Number (FEIN) of the recipient related member in Field 1a, followed by the recipient related member's name in Field 1b.

- Complete Field 2 by entering the amount of intangible expenses that resulted from transactions with the recipient related member.

- Next, in Field 3, record the interest expense amounts resulting from transactions with the related member.

- Then, fill in Field 4 with the management fee expense amounts incurred from transactions with the recipient related member.

- Calculate the total amount of interest, intangible, and management fee expenses incurred, and enter this total in Field 5.

- In Field 6, enter the amount exempted from add-back due to the absence of Louisiana tax avoidance as the principal purpose of transactions.

- Then, in Field 7, enter any amounts that were paid to non-related persons that qualify for exemption from add-back.

- Proceed to Fields 8a through 8f, detailing jurisdictions where the related member income is subject to tax and calculating exempt amounts based on the related member’s income.

- Finally, ensure to sum the total interest/intangible/management fee expenses for all related members in Field 10 and the total exempt amount in Field 11.

- Once all fields are filled out, you can save your changes, download, print, or share the completed R 6950 form as necessary.

Start completing your documents online today for a seamless filing experience.

Visit the Forms, Instructions & Publications page to download products or call 800-829-3676 to place your order.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.