Loading

Get Form 300 Withdrawal Request - Utah Educational Savings Plan - Uesp

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 300 Withdrawal Request - Utah Educational Savings Plan - Uesp online

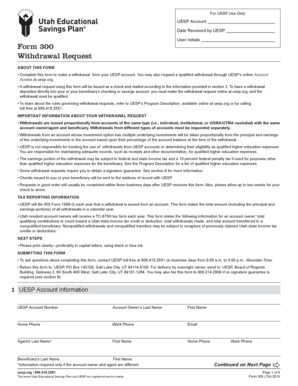

The Form 300 Withdrawal Request allows users to request a withdrawal from their Utah Educational Savings Plan (UESP) accounts. This guide will provide clear and structured instructions on how to fill out the form online, ensuring that you complete it accurately and efficiently.

Follow the steps to successfully complete the Form 300.

- Click the ‘Get Form’ button to access the Form 300 Withdrawal Request and open it for editing.

- In section 1, provide your UESP Account number followed by the account owner's last name, first name, home phone, work phone, and email. If applicable, fill in the agent's last name and first name alongside their home phone. Lastly, include the beneficiary's last name and first name.

- In section 2, specify the withdrawal amount by selecting either a partial balance or full balance withdrawal. If choosing to withdraw the full balance, indicate whether you want to leave the account open by checking the designated box.

- In section 3, determine the check payee. You must indicate whether the check should be made payable to the account owner, beneficiary, or an eligible educational institution. Fill out the necessary details if it is being sent to an institution.

- In section 4, select the appropriate withdrawal type, such as a qualified withdrawal or nonqualified withdrawal. Ensure to fill in additional information if applicable.

- In section 5, review and sign the signature authorization. It confirms the authorization of the withdrawal request and acknowledges the associated tax responsibilities.

- If required, complete section 6 for the signature guarantee and follow the instructions provided for obtaining a valid signature guarantee.

- Finally, print the completed form. After printing, sign the form, and remember to close your browser to protect your personal information. You can then submit your form to UESP via mail or fax, as appropriate.

Complete your Form 300 Withdrawal Request online today for a smooth and efficient processing experience.

A provision for 529 plans allows a person to contribute $85,000 ($170,000 for married couples) in one year by treating the contribution as if it were made in equal installments over five years.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.