Loading

Get Form 3563

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 3563 online

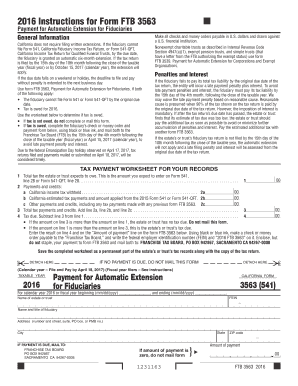

Filling out Form 3563 online is a straightforward process that can help fiduciaries request an automatic extension for their tax responsibilities. This guide provides detailed instructions to ensure that users easily navigate and complete the form accurately.

Follow the steps to successfully complete your Form 3563 online.

- Click ‘Get Form’ button to obtain the form and open it in your selected editor.

- Indicate the taxable year by entering the year, either for calendar or fiscal year, in the designated field.

- Provide the name of the estate or trust in the appropriate section, followed by the name and title of the fiduciary responsible for the filing.

- Fill in the address details of the estate or trust, ensuring to include all required components such as the street address, city, state, and ZIP code.

- Complete the 'Amount of payment' field, indicating the total tax due calculated from the worksheet provided in the instructions.

- If payment is due, prepare a check or money order payable to the 'Franchise Tax Board,' writing the federal employer identification number and '2016 FTB 3563' on it.

- Enclose the payment with Form 3563, ensuring not to staple them together. Prepare to mail both to the Franchise Tax Board at the designated address.

- Once all information is filled out, review the form carefully for accuracy. Save any digital changes made during the process.

- After confirmation of all details, you can save changes, download, print, or share the completed form as needed.

Complete your Form 3563 online today to ensure timely processing of your tax extension.

If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts. An estate may also need to pay quarterly estimated taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.