Loading

Get State Form 44405

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State Form 44405 online

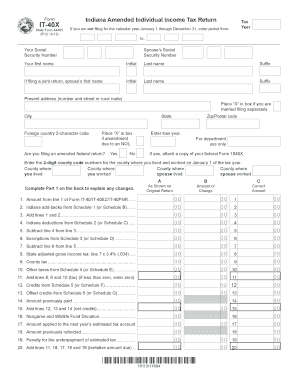

State Form 44405, known as the Indiana Amended Individual Income Tax Return, allows users to amend their previous tax returns. This guide provides clear instructions on how to accurately complete the form online, ensuring that users can do so with confidence and ease.

Follow the steps to successfully complete the State Form 44405 online.

- Click ‘Get Form’ button to obtain the form and open it in the editing interface.

- Enter your tax year in the designated field, specifying the begin and end dates if it is not a calendar year.

- Fill in your Social Security number and, if applicable, your spouse’s Social Security number.

- Input your name, initial, last name, and any suffix, along with your spouse’s information if filing jointly.

- Provide your current address including number, street, city, state, and zip code. Indicate any foreign country if necessary.

- Select the appropriate filing status by placing an ‘X’ in the box for married filing separately, if applicable.

- Indicate if the amendment is due to a Net Operating Loss (NOL) by marking the corresponding box.

- Answer whether you are filing an amended federal return by selecting ‘Yes’ or ‘No’. If 'Yes', attach a copy of your federal Form 1040X.

- Fill in the county codes for where you lived and worked on January 1 of the tax year.

- Complete Part 1 on the back of the form to explain any changes made, summing up amounts as per the lines indicated.

- Review the amounts in each calculation field, ensuring that all additions and subtractions follow the instructions provided.

- Determine the refund or amount due based on the lines corresponding to the totals calculated.

- Provide your signature and the date, along with your spouse’s signature if applicable.

- Fill in the daytime telephone number and email address for contact purposes.

- If applicable, complete information of your paid preparer or personal representative.

- Double-check all provided information for accuracy and make necessary corrections.

Complete your State Form 44405 online today for a smooth and efficient filing experience.

Only those who filed an Indiana resident tax return for the 2020 tax year by Dec. 31, 2021, qualified for the $125 ATR. DOR issued direct deposits beginning in May 2022 for those who qualified for the $125 refund and provided direct deposit information for their tax refund on their 2021 Indiana Income Tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.