Loading

Get Scnetfile

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Scnetfile online

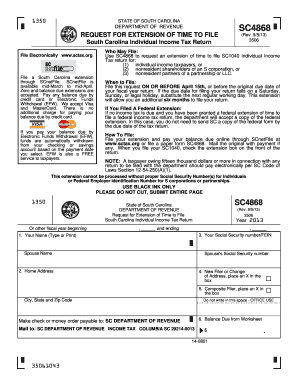

Filing for an extension on your South Carolina Individual Income Tax Return can be straightforward with the right guidance. This user-friendly guide will walk you through each section of the Scnetfile to ensure you provide all necessary information seamlessly and accurately.

Follow the steps to successfully fill out the Scnetfile online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering your name in the designated field. Ensure your name is typed clearly, as it will be used for identification purposes.

- Provide your home address in the following section. Make sure to include your city, state, and ZIP code accurately.

- If you are a new filer or if your address has changed since your last filing, place an 'X' in the corresponding box.

- Indicate whether you are a composite filer by placing an 'X' in the appropriate box.

- Enter your Social Security Number or Federal Employer Identification Number for S corporations or partnerships in the indicated field.

- Complete the Tax Computation Worksheet to calculate any balance due. Pay careful attention to each line to ensure accurate reporting of income tax owed, use tax, and withholding credits.

- Transfer the total balance due calculated in the worksheet to Line 6 of the Scnetfile. Be aware that this payment is required with your extension form.

- Once all fields are filled out, review your information for accuracy before proceeding to submit the form electronically.

- After submission, ensure to save changes if prompted, download or print a copy of your completed form for your records, or share it as necessary.

Start filling out your Scnetfile online today to ensure you meet your filing obligations!

Individual tax filers, regardless of income, can use IRS Free File to electronically request an automatic tax-filing extension. Filing this form gives you until October 15 to file a return. If October 15 falls on a Saturday, Sunday, or legal holiday, the due date is delayed until the next business day.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.