Loading

Get Rita S Efile

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RITA S EFile online

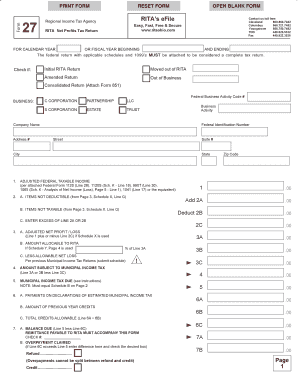

Filling out the RITA S EFile online is an essential process for businesses to report their income and calculate applicable taxes. This guide provides comprehensive, step-by-step instructions to aid users in completing the form accurately.

Follow the steps to complete the RITA S EFile online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Indicate the tax year for which you are filing, specifying whether it is for the calendar year or a fiscal year by providing the start and end dates.

- Check the applicable boxes to indicate the type of RITA return: initial, moved out of RITA, amended return, out of business, or consolidated return.

- Enter the business name, address, and federal business activity code number in the provided fields.

- Calculate and fill in the adjusted federal taxable income based on the relevant federal forms, specifying any non-deductible or non-taxable items.

- Use the provided fields to detail the adjusted net profit or loss and enter the amount subject to municipal income tax.

- Calculate the municipal income tax due, which must equal the figures on Schedule B of the form.

- Provide information on any payments made towards estimated municipal income tax and previous year credits.

- Complete the balance due or overpayment claimed section as necessary.

- Certify the accuracy of the return by signing and providing the required preparer information, including their contact details.

- Review the form for completeness and accuracy before submitting, saving or printing the document as needed.

Begin completing your RITA S EFile online now to ensure timely processing and compliance.

Yes, you can file an original Form 1040 series tax return electronically using any filing status. Filing your return electronically is faster, safer, and more accurate than mailing your tax return because it's transmitted electronically to the IRS computer systems.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.