Loading

Get Boe-501-bw (front) Rev

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the BOE-501-BW (FRONT) REV online

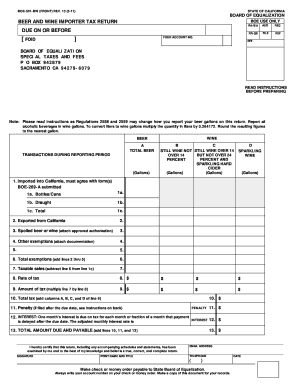

Filling out the BOE-501-BW (FRONT) REV form is essential for beer and wine importers to report their tax obligations accurately. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring compliance with state regulations.

Follow the steps to complete your BOE-501-BW (FRONT) REV form effortlessly.

- Click the ‘Get Form’ button to obtain the form and open it in your editor.

- Begin by filling in your account number where indicated. This ensures your submission is associated with your specific tax account.

- In the section marked 'Transactions during reporting period,' input the total gallons of each type of beverage imported into California. Ensure these figures correspond with previously submitted BOE-269-A forms.

- For boxes labeled A through D, report the gallons for beer, still wine, and sparkling wines accordingly. Ensure you categorize them accurately based on the beverage's specifications.

- Calculate total exemptions by adding lines 2 through 5. This includes exports from California, spoiled beverages, and other documented exemptions.

- Figure the taxable sales amount by subtracting the total exemptions (line 6) from the total gallons (line 1c).

- Enter the applicable tax rate in the designated area. This rate will be used to calculate your final tax amount.

- Calculate the total tax due by multiplying the taxable sales amount (line 7) by the tax rate (line 8).

- Complete the penalty and interest sections if applicable, referring to the instructions provided on the form.

- Sum the total tax, penalty, and interest to determine the 'Total Amount Due and Payable.'

- Certify your return by signing and providing your printed name, title, email address, and telephone number.

- After reviewing your form for accuracy, save your changes, download the completed document, or print it for submission.

Begin filling out your BOE-501-BW (FRONT) REV form online today to ensure timely and accurate tax reporting.

California Constitution, Article XIII, Section 34. (a) In General. Tax does not apply to sales of food products for human consumption except as provided in Regulations 1503, 1574, and 1603. (Grocers, in particular, should note that tax applies to sales of "hot prepared food products" as provided in Regulation 1603(e).)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.