Loading

Get Formulario 499 R-1b Rev

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Formulario 499 R-1B Rev online

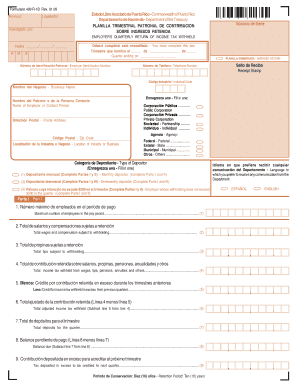

The Formulario 499 R-1B Rev is a crucial document for employers in Puerto Rico, used for reporting quarterly income tax withheld. This guide provides step-by-step instructions to help users navigate the form effortlessly, ensuring complete and accurate submissions.

Follow the steps to complete the Formulario 499 R-1B Rev online.

- Click ‘Get Form’ button to acquire the form and open it in your preferred digital editor.

- Enter the quarter ending date by filling in the day, month, and year in the designated fields. Ensure accuracy to avoid complications.

- Input the employer identification number, which is critical for processing the form correctly.

- Specify the language preference for communication from the Department by selecting either 'English' or 'Español'.

- Complete the business information, including the name of the business, postal address, and location of the business.

- Indicate the category of depositor by selecting one of the options provided regarding your withholding status.

- In Part I, report the maximum number of employees during the pay period and total wages liable for withholding in the appropriate lines.

- Continue filling in the total tips and withholdings, ensuring all calculations are accurate and complete.

- Review the final calculations for total adjusted withholdings and ensure any excess deposits are noted appropriately.

- Once all sections are filled out, review the form for accuracy before saving your changes. You can then choose to download, print, or share the completed form as needed.

Begin completing your Formulario 499 R-1B Rev online today to ensure timely and accurate submissions.

An exemption of the income tax withholding is provided for employees from ages 16 to 26 on the first $40,000 of taxable wages. The withholding rates depend upon the personal exemption and credits for dependents claimed in the withholding exemption certificate (Form 499R4l) to be completed by every employee.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.