Loading

Get Ct 1127

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct 1127 online

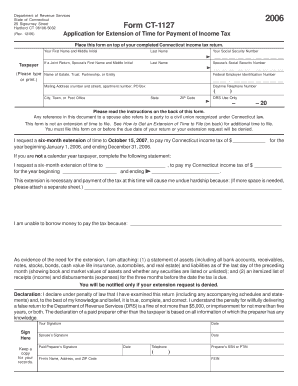

This guide provides clear and concise instructions for filling out the Ct 1127 form online. Whether you are seeking an extension for your income tax payment or need assistance with any section, this resource aims to support you in successfully completing the form.

Follow the steps to complete the Ct 1127 form online.

- Click ‘Get Form’ button to access the form and open it in your preferred online editor.

- Enter your first name and middle initial, followed by your last name. This information identifies you as the applicant.

- Provide your Social Security number, ensuring that it is entered correctly to avoid any issues with processing.

- If applicable, enter your spouse’s Social Security number in the designated area. Note that this applies whether you are married or in a civil union.

- If it applies to your situation, provide the Federal Employer Identification Number (EIN) for your entity.

- Include your daytime telephone number to allow the Department of Revenue Services to contact you if necessary.

- If filing a joint return, enter your spouse’s first name and middle initial along with their last name.

- Complete the mailing address section by entering your street address, apartment number (if applicable), city or town, state, and ZIP code.

- Indicate your request for a six-month extension by filling in the applicable fields regarding the payment of Connecticut income tax, including the amount and the appropriate dates.

- If not a calendar year taxpayer, fill out the specific dates for tax payment as outlined in the form.

- Explain why the extension is necessary by detailing any undue hardship caused by immediate tax payment. Use additional sheets if necessary.

- Describe why borrowing funds is not an option for you, if applicable. Include supporting information as necessary.

- Attach the required evidence to support your need for an extension, including a statement of assets and an itemized list of income and expenses.

- Read and sign the declaration to confirm that all provided information is true and complete. Include the date and your spouse's signature if applicable.

- Finally, save your changes, download, print, or share the completed form as needed.

Ensure your tax matters are managed effectively by completing your Ct 1127 form online today.

You are a nonresident for the 2022 taxable year if you are neither a resident nor a part-year resident for the 2022 taxable year. If you are a nonresident and you meet the requirements for Who Must File Form CT‑1040NR/PY for the 2022 taxable year, you must file Form CT‑1040NR/PY.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.