Loading

Get Warren County Schools Net Profit Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Warren County Schools Net Profit Tax Return online

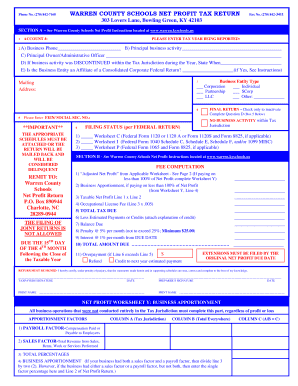

Filing the Warren County Schools Net Profit Tax Return online is an essential process for businesses operating within the jurisdiction. This guide provides clear and straightforward instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the form correctly online:

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your account number in the designated field. This is crucial for identification purposes.

- Next, specify the tax year being reported to ensure the correct assessment period is used.

- Provide your business phone number and principal business activity in the corresponding fields.

- Identify the principal owner or administrative officer, entering their full name and contact details.

- If your business activity was discontinued during the year within the tax jurisdiction, please indicate the date in the specified section.

- Select the appropriate business entity type from the list provided: corporation, individual, partnership, SCorp, LLC, or other.

- If applicable, fill in your FEIN or Social Security number to comply with identification requirements.

- Navigate to the fee computation section and fill in the adjusted net profit as calculated from the applicable worksheet.

- For businesses paying on less than 100% of net profit, provide the business apportionment details, if necessary.

- Calculate the taxable net profit by multiplying the net profit by the apportionment factor.

- Determine the occupational license fee based on the taxable net profit and ensure it's accurately calculated.

- Summarize your total tax due, less any estimated payments or credits.

- Complete any penalties, interests, and total amount due as necessary.

- If applicable, state any overpayment and indicate if you wish for a refund or credit to the next year's estimation.

- Finally, ensure the form is signed and dated by both the taxpayer and preparer, certifying the accuracy of the information provided.

Complete your Warren County Schools Net Profit Tax Return online today to ensure compliance and avoid potential penalties.

Income Tax Department The City of Warren levies a 2.5% income tax on all salaries, wages, commissions, and other compensation received by residents of the city, on non-residents for income earned in the city, on partnerships, corporations, and any other entity having taxable income under City Ordinances.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.