Loading

Get Boe-501-hg (s1f) Rev

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the BOE-501-HG (S1F) REV online

This guide provides users with detailed instructions on filling out the BOE-501-HG (S1F) REV form online. Follow these steps to ensure accurate completion and submission of your hazardous waste generator fee return.

Follow the steps to complete the BOE-501-HG (S1F) REV form online.

- Click the ‘Get Form’ button to obtain the BOE-501-HG (S1F) REV and open it in the digital editor for completion.

- Review the form thoroughly. Before filling it out, ensure you understand the instructions provided. This will help in accurate data entry.

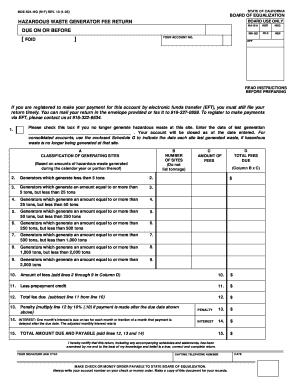

- Indicate whether you no longer generate hazardous waste at the specified site by checking the relevant box and entering the date of last generation if applicable.

- In Section A, classify your generating sites by selecting the appropriate category based on the amount of hazardous waste generated. Ensure that you do not list tonnage but only the number of sites.

- Fill in the number of sites for each category in Column B, corresponding to the classification of hazardous waste generation.

- Calculate and enter the amount of fees due for each category in Column C, then multiply the number of sites in Column B by the fees in Column C to enter the totals in Column D.

- Add the totals from Column D to find the total amount of fees due in line 10.

- Account for any prepayment credit by entering the amount on line 11 and calculating the total fee due on line 12.

- Calculate any applicable penalties or interest if applicable and enter these amounts on lines 13 and 14.

- Complete the certification section by signing and dating the form, and providing a daytime telephone number for any follow-up communication.

- Once all sections are completed, save the changes to your form. You can then download, print, or share the form as necessary for your records.

Complete your hazardous waste generator fee return online today for a timely submission.

In general, businesses which provide a service that does not result in a tangible good are exempt from sales tax, as it only applies to goods. For example a freelance writer or a tradesperson is not required to remit sales tax, although a carpenter making custom furniture is so required.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.