Loading

Get 2003 Form 6765. Credit For Increasing Research Activities

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2003 Form 6765. Credit for Increasing Research Activities online

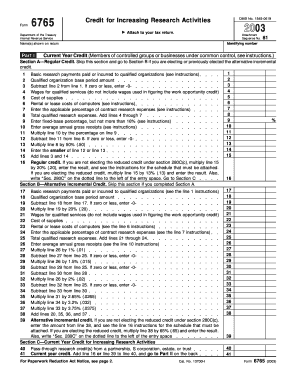

The 2003 Form 6765 is essential for businesses seeking credit for increasing research activities. This guide provides comprehensive, step-by-step instructions to help users complete the form accurately and confidently.

Follow the steps to fill out the form effectively.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out the identifying information, including the name(s) shown on your return and your identifying number.

- In Part I, determine whether to use the Regular Credit or the Alternative Incremental Credit, based on your prior elections.

- For Regular Credit, enter basic research payments and calculate the total qualified research expenses by summing wages, costs of supplies, rental costs, and applicable contract research expenses.

- Calculate the fixed-base percentage and average annual gross receipts, then determine your eligible credit by following the prompts for each line in Section A.

- If opting for the Alternative Incremental Credit, follow the same outlined process but refer to Section B for the specific calculations required.

- Continue to Section C to sum the current year credit from any pass-through research credits.

- Complete Part II by entering relevant tax information from your returns, ensuring accuracy as these figures are pivotal for determining your credit allowance.

- Review the completed form for any errors or omissions, then save, download, or print the form as necessary to ensure you have a copy for your records.

Take action today and complete your documents online for optimal efficiency.

Purpose of Form Use Form 6765 to figure and claim the credit for increasing research activities, to elect the reduced credit under section 280C, and to elect to claim a certain amount of the credit as a payroll tax credit against the employer portion of social security taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.