Loading

Get Instructions For Preparing Form Ncui 604

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the instructions for preparing form NCUI 604 online

This guide provides clear and comprehensive instructions on how to fill out the form NCUI 604, also known as the employer status report. By following these steps, users will be able to accurately complete the necessary fields online and submit the form with confidence.

Follow the steps to complete the employer status report accurately.

- Press the ‘Get Form’ button to access and open the NCUI 604 form in your preferred document editor.

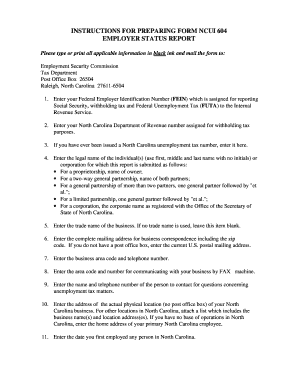

- Enter your federal employer identification number (FEIN) in the designated field. This number is required for reporting social security, withholding tax, and federal unemployment tax to the Internal Revenue Service.

- Next, input your North Carolina Department of Revenue number that has been assigned for withholding tax purposes.

- If you have previously been issued a North Carolina unemployment tax number, please provide it in the appropriate section.

- Complete the field with the legal name of the individual(s) or corporation submitting this report. For sole proprietorships, include the owner's full name. For partnerships, include the names of all partners or 'et al.' for larger partnerships.

- If your business operates under a trade name, please enter it here. If there is no trade name, you may leave this section blank.

- Provide the complete mailing address for business correspondence, including the zip code. If a post office box is not available, input your current U.S. postal mailing address.

- Fill in the business area code and telephone number to allow for communication regarding your business.

- Enter the area code and number for fax communications with your business.

- Identify the contact person for unemployment tax matters by entering their name and telephone number.

- Input the physical address of your North Carolina business location. If there are multiple locations, attach a detailed list showing names and addresses. If you have no base of operations in North Carolina, enter the home address of your primary employee in the state.

- Indicate the date when you first employed any person in North Carolina.

- Respond to items 12 through 16 according to your employment information. For general business employment, provide the count of employees as applicable.

- If you employ individuals in agricultural labor, count and report any week in which you employed as many as 10 individuals.

- For domestic employment, assess the number of individuals employed in household services and report any cash payments made.

- If applicable, confirm whether you are a non-profit organization by attaching relevant IRS documentation.

- Check the appropriate item if you are required to pay federal unemployment tax and provide the required calendar years.

- If you have acquired or merged with another business, provide the necessary details about the transaction.

- Report the type of ownership structure for your business and provide supporting information as required.

- Input the full names, titles, home addresses, social security numbers, and contact numbers of all owners, general partners, or principal corporate officers.

- Check the box if you wish to voluntarily cover your employees for unemployment insurance.

- If applicable, attach a list of independent contractors without a federal employer identification number.

- Describe the services provided or products sold by your business.

- If your business is part of a larger organization providing support services, check the appropriate box and describe the activity.

- Review all completed sections carefully to ensure accuracy. Sign and date the form before submitting it to the designated address.

Complete your form NCUI 604 online today to ensure compliance with employment tax reporting requirements.

For What Reasons Can You Be Denied Unemployment? Failing to Meet the Earnings Requirements. Quitting Your Last Job. Getting Fired for Misconduct.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.