Loading

Get Cert 135

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cert 135 online

Filling out the Cert 135 form online can streamline your document management process for vehicle purchases. This guide provides step-by-step instructions to assist users of all backgrounds in completing the form accurately.

Follow the steps to successfully complete the Cert 135 online.

- Click ‘Get Form’ button to access the Cert 135. This will allow you to open the document in the online editor.

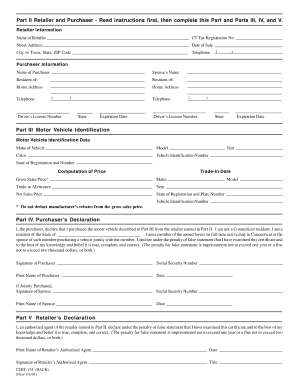

- Begin with the Retailer Information section. Input the retailer's name, Connecticut Tax Registration Number, street address, date of sale, city or town, state, ZIP code, and telephone number.

- Move to the Purchaser Information section. Provide the purchaser's name, their partner’s name if applicable, resident details including addresses, and telephone numbers. Additionally, fill in the driver's license numbers for both the purchaser and their partner along with the corresponding states and expiration dates.

- In Part III, Motor Vehicle Identification, enter detailed information about the vehicle. This includes the make, model, year, color, vehicle identification number, and state of registration with the registration number.

- Complete the Computation of Price section by stating the gross sales price. Make sure to include trade-in details such as make, model, year, and trade-in allowance. Finally, calculate the net sales price.

- In Part IV, Purchaser's Declaration, provide the necessary declaration statement indicating residency, military status if applicable, signature of the purchaser, social security number, and print name. If the vehicle was jointly purchased, include the spouse's details as well.

- Fill out Part V, Retailer’s Declaration, by providing the print name and signature of the retailer's authorized agent, along with their title and date.

- After completing the form, review all entries for accuracy. Once satisfied, you can save the changes, download, print, or share the completed Cert 135 document.

Complete your Cert 135 document online today for a seamless vehicle purchasing experience.

What are the Connecticut personal exemptions? An unmarried person or a married person filing separately for federal income tax purposes whose Connecticut adjusted gross income is $24,000 or less is entitled to an exemption of $12,000.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.