Loading

Get Fatca - Crs Declaration Form - Entities 03112015 (1) - Ambit

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FATCA - CRS Declaration Form - Entities 03112015 (1) - Ambit online

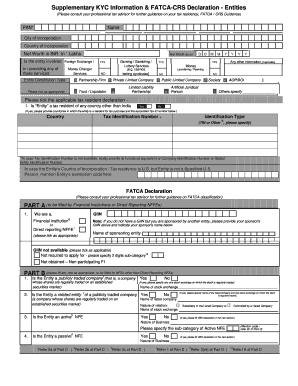

Filling out the FATCA - CRS Declaration Form - Entities 03112015 (1) - Ambit is essential for compliance with international tax regulations. This guide provides clear instructions to assist users in completing the form correctly and efficiently.

Follow the steps to complete the form accurately.

- Press the ‘Get Form’ button to access the form and open it in your editor.

- Begin by entering your PAN (Permanent Account Number). Ensure that this number is correct, as it identifies your entity for tax purposes.

- Fill in the entity's name, city of incorporation, and country of incorporation. This information establishes the basic identity of your entity.

- Provide the net worth in Indian Rupees (INR) using the specified 'Lakhs' format and include the date as of which this net worth applies.

- Indicate if the entity is involved in any foreign exchange services by ticking the appropriate boxes for services like money changing or gambling.

- Select the type of entity constitution. Choose from the provided options such as public limited company, private limited company, limited liability partnership, or partnership firm.

- Identify the entity's tax residency by specifying if it is a tax resident of any country other than India. If so, provide the country and corresponding tax identification number.

- Part A includes determining if your entity is a financial institution or a direct reporting non-financial foreign entity (NFFE). Select the appropriate classification and provide the GIIN if applicable.

- In Part B, indicate if your entity is publicly traded or related to a publicly traded entity, and specify the stock exchange if applicable.

- Complete the UBO (ultimate beneficial owner) declaration, detailing controlling persons, tax residency, and tax identification numbers.

- Review the FATCA terms and conditions that pertain to compliance and understand the requirements that accompany this form.

- Finally, certify that the information provided is accurate by inputting your name, designation, and date, and sign the document. After completing, you can save your changes, download, print, or share the form.

Complete your FATCA - CRS Declaration Form online with confidence.

Depository institutions - includes savings banks, commercial banks, savings and loan associations, and credit unions; • Custodial Institutions - includes custodian banks, brokers, and central securities depositories; • Investment Entities - includes entities investing, reinvesting or trading in financial instruments, ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.