Loading

Get Mo Modes-4 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO MODES-4 online

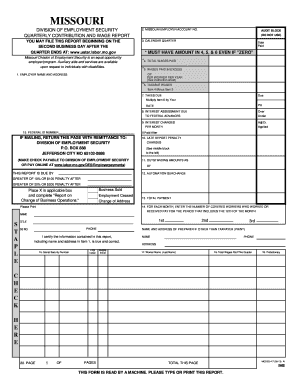

The MO MODES-4 form is essential for submitting your quarterly contribution and wage report to the Missouri Division of Employment Security. This guide provides clear, step-by-step instructions to help you navigate the online form efficiently.

Follow the steps to successfully complete the form.

- Click the ‘Get Form’ button to obtain the MO MODES-4 form and open it in the editor.

- Enter your employer name and address in the first section of the form. Ensure that all details are accurate and complete.

- Provide your Missouri employer account number in the designated field. This is necessary for proper identification and processing of your submission.

- Specify the calendar quarter for which you are reporting wages. Make sure to select the correct quarter.

- Fill out the total wages paid in Item 4. This should include all wages paid during the quarter, even if the amount is zero.

- Indicate any wages paid in excess of the specified amount per worker per year in Item 5. Refer to the instruction sheet for clarification on limits.

- Calculate taxable wages for Item 6 by subtracting the amount in Item 5 from Item 4.

- In Item 7, determine the taxes due by multiplying the amount in Item 6 by your rate.

- Item 8 captures any interest assessment due. Ensure to provide fees accurately.

- Complete Items 9 through 12 regarding federal ID numbers, interest charges, and other relevant amounts.

- Enter outstanding amounts as of the specified date in Item 11.

- Calculate total payment due in Item 13, summing all applicable amounts.

- In Item 14, enter the number of covered workers who worked or received pay during the month, as specified.

- Provide information about the preparer, if it is different from the taxpayer, ensuring accuracy of contact details.

- Once all information is completed, review the form for any errors or missing data.

- Finally, save your changes, and choose to download, print, or share the form as necessary.

Complete your MO MODES-4 form online today to ensure timely submission of your quarterly report.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

There are several reasons why your unemployment claim may be denied in Missouri. Common reasons include failing to meet eligibility requirements, such as insufficient work history or income, misconduct while employed, or resigning without good cause. To better understand the appeals process and improve your chances, reviewing your situation against the MO MODES-4 criteria can be beneficial.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.