Loading

Get Gua-donation-contribution-form (1).docx

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Gua-donation-contribution-form (1).docx online

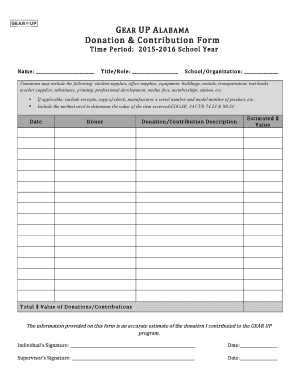

This guide provides step-by-step instructions on how to fill out the Gua-donation-contribution-form (1).docx online. By following these clear and straightforward steps, users can ensure that their donations and contributions are accurately reported and documented.

Follow the steps to successfully complete the form online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in your name in the designated space provided at the top of the form.

- Enter your title or role in the relevant section.

- Provide the name of your school or organization.

- List the items you are donating, categorizing them as student supplies, office supplies, equipment, or other relevant types.

- If applicable, attach receipts, a copy of the check, or any other proof of the items donated.

- Indicate the method used to determine the value of the items, referencing EDGAR and any applicable regulations.

- Estimate the value of your donation and input the amount in the designated field.

- Sign the form in the individual’s signature section to confirm the accuracy of the information.

- If required, have a supervisor review and sign the form.

- Finally, save your changes, download a copy of the completed form, and print or share it as needed.

Complete your donation documentation online today!

About Form 8283, Noncash Charitable Contributions. Internal Revenue Service.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.