Loading

Get Hawaii Schedule X

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Hawaii Schedule X online

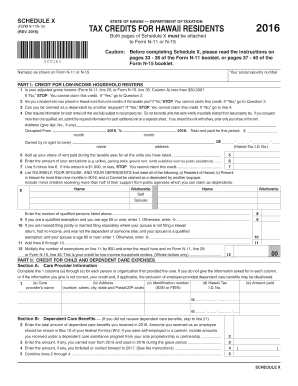

The Hawaii Schedule X is an important document for residents seeking tax credits related to low-income household renters and child and dependent care expenses. This guide will provide clear instructions on how to fill out the Schedule X form online, making the process as straightforward as possible.

Follow the steps to complete the Hawaii Schedule X online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name(s) as shown on Form N-11 or N-15 and your social security number in the designated fields.

- For Part I, 'Credit for Low-Income Household Renters', answer the questions regarding your adjusted gross income, residency, and dependency status.

- If eligible, provide information for each rental unit that you occupied, ensuring to list only units fully subject to real property tax, including the total rent paid during that period.

- Calculate your exclusions and determine if the amount after exclusions is $1,000 or less. If it is, you cannot claim the credit.

- List yourself, your partner, and dependents meeting the qualifications. Enter the number of qualified persons identified.

- Complete Part II, 'Credit for Child and Dependent Care Expenses'. Fill in the care provider information and amounts for dependent care benefits.

- Enter total qualified expenses incurred for care and follow the necessary calculations for credits based on family income.

- Complete any remaining calculations related to your dependent care expenses, ensuring to follow the guidance provided.

- Once you have finished filling out the form, review all information for accuracy before saving the changes, downloading, printing, or sharing the completed form.

Start completing your Hawaii Schedule X online today to ensure you receive any eligible tax credits.

If an individual does business in Hawaii, he or she must file a return, even if no taxable income is derived from that business. (Instructions, Form N-15, Individual Income Tax Return—Nonresident and Part-Year Resident) However, a nonresident will be taxed on income from Hawaii sources only.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.