Loading

Get Ie Ppa1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IE PPA1 online

Filling out the IE PPA1 form online can be a straightforward process if you follow the appropriate steps. This guide provides detailed instructions to help you successfully complete the form, ensuring that all necessary information is accurately provided.

Follow the steps to complete your IE PPA1 application.

- Press the ‘Get Form’ button to access the IE PPA1 application form and open it in your preferred online editor.

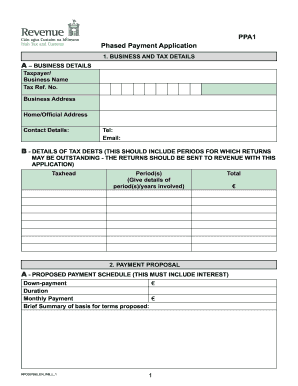

- In the 'Business and Tax Details' section, enter your taxpayer or business name, tax reference number, and the business address, including contact details such as telephone number and email address.

- For the 'Details of Tax Debts' section, list any outstanding tax debts, detailing the periods involved. Be sure to provide the necessary returns along with the application.

- In the 'Payment Proposal' section, propose a payment schedule which should include the down payment, duration, monthly payment amount, and a brief summary explaining the basis for the proposed terms.

- Fill in details under the 'Repayment Capacity', providing information about your bank and any other financial institutions, including account types, current balances, and whether accounts are joint.

- Outline current lending commitments of your business in the related section. Include details of loans, repayments, and whether the repayments are up to date.

- Specify details of any debts owed to your business and the age of those debts. Indicate if there is a payment plan in place and provide a summary of any agreements.

- Discuss how the proposed repayment schedule will be serviced, ensuring you address future tax payments and other debts.

- Provide additional information as necessary, including any invoice discounting or factoring arrangements, and last and next bank review details.

- Demonstrate your business viability by explaining your capacity to repay debts and ensuring timely future payments.

- Complete the 'Tax Clearance Requirement' by indicating whether you need a tax clearance certificate if your proposal is accepted.

- Finally, review your entries for accuracy and completeness. Sign the declaration, providing your name in block capitals and the date.

- Once finished, save your changes, and download or print the completed form for submission.

Begin filling out your IE PPA1 form online to manage your tax payments efficiently.

Related links form

Before its discontinuation, the 1040EZ was available to individuals with a taxable income under specific thresholds, typically around $100,000. Though this form is no longer available, the standard Form 1040 has similar guidelines. Accessing the IE PPA1 tools through the US Legal Forms platform will help you determine your eligibility for various tax forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.