Loading

Get D-30p Payment Voucher

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the D-30P PAYMENT VOUCHER online

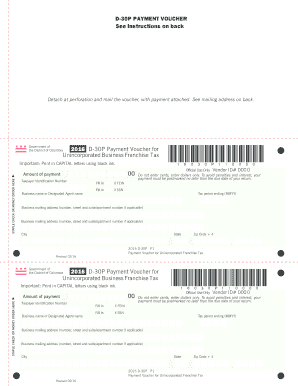

The D-30P Payment Voucher is an essential form used to facilitate payments for unincorporated business franchise taxes in Washington D.C. This guide will provide clear, step-by-step instructions to help users complete the form accurately online.

Follow the steps to fill out the D-30P Payment Voucher correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your Taxpayer Identification Number in the designated field. Indicate whether this is your Federal Employer Identification Number (FEIN) or your Social Security Number (SSN) by filling in the corresponding oval.

- Next, enter your business name or the name of your designated agent as it appears on your tax return.

- Provide your complete business mailing address, including the number, street, and any suite or apartment numbers, followed by the city, state, and zip code.

- In the payment section, input the total amount due in dollars only, omitting any cents. Ensure that this amount represents your full payment.

- Prepare your payment by writing a check or money order made payable to the DC Treasurer. It is crucial to include your FEIN/SSN, the tax period, and the type of return filed (D-30) on your payment.

- Staple your check or money order securely to the D-30P Payment Voucher. Do not attach it to your D-30 return.

- Once completed, review all the information for accuracy, and then save your changes. You may choose to download, print, or share the completed form as needed.

Complete your D-30P Payment Voucher online today for a smooth filing experience.

Taxicab/Limo Drivers Any non-resident taxicab/limo driver who operates a motor vehicle for hire in the District must file a Form D-30. The filing of the D-30 is a requirement for operating or continuing to operate a motor vehicle for hire in the District by a non-resident.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.