Loading

Get Edf Form Mauritius 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Edf Form Mauritius 2016 online

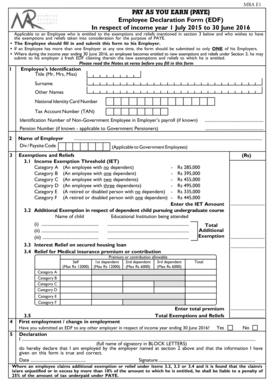

Filling out the Edf Form Mauritius 2016 online is an essential process for employees seeking exemptions and reliefs under the Pay As You Earn (PAYE) tax system. This guide will provide clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to fill out the Edf Form Mauritius 2016 online.

- Click the ‘Get Form’ button to access the online version of the Edf Form Mauritius 2016.

- Begin by filling in your personal details in the Employee's Identification section. Enter your title, surname, other names, national identity card number, and tax account number. If applicable, include your non-government employee identification number and pension number.

- Next, provide the name of your employer and the division or paysite code, which can usually be found on your salary statement or employee records.

- Move on to the Exemptions and Reliefs section. Select the appropriate income exemption threshold category based on your number of dependents. Enter the exemption amount in the designated field.

- If you have dependents pursuing undergraduate courses, list their names and the educational institutions they are attending to secure additional exemptions.

- Complete the Interest Relief on secured housing loan section if applicable. Enter the total premium you wish to claim for yourself and any dependents.

- Proceed to the declaration section. Ensure that you read the information carefully, fill in your full name in BLOCK LETTERS, and date your signature to validate the form.

- Verify all the information entered on the form for accuracy before submitting it. Make sure you have not submitted another EDF to a different employer.

- Once you have filled out the form, you can save changes, download, print, or share the completed Edf Form Mauritius 2016.

Complete the Edf Form Mauritius 2016 online today to ensure you receive all eligible exemptions and reliefs.

Are all emoluments taxable? All emoluments are taxable except the following: Emoluments derived from the office of the President or Vice-President.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.