Loading

Get Resident Or Nonresident Alien Decision Tree

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Resident Or Nonresident Alien Decision Tree online

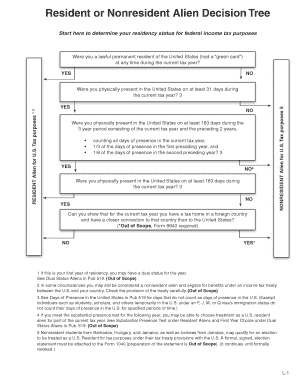

This guide offers a clear and supportive approach to completing the Resident Or Nonresident Alien Decision Tree. By following these steps, users can determine their residency status for federal income tax purposes efficiently.

Follow the steps to fill out the Resident Or Nonresident Alien Decision Tree online.

- Press the 'Get Form' button to access the decision tree form and open it in your preferred online document editor.

- Begin by answering the first question: Were you a lawful permanent resident of the United States (possessing a 'green card') at any time during the current tax year? Choose 'Yes' or 'No' depending on your status.

- If you answered 'No' to the first question, proceed to the next inquiry: Were you physically present in the United States on at least 183 days during the three-year period including the current tax year and the two preceding years? Review your presence using the outlined calculations before selecting 'Yes' or 'No.'

- If you select 'Yes,' check whether you were physically present in the United States on at least 183 days during the current tax year by answering the next question. Choose 'Yes' or 'No.'

- If you answer 'No' to being present for at least 183 days this year, you will need to confirm if you were present for at least 31 days. Respond accordingly.

- For users who were present for at least 31 days, determine if you can establish a tax home in a foreign country. If your connection is closer to that country than to the United States, select 'Yes' or 'No.'

- Based on your responses, the decision tree will indicate whether you are classified as a resident or nonresident alien for U.S. tax purposes. Complete this form by saving your changes, and you can download, print, or share the document as needed.

Start filling out the Resident Or Nonresident Alien Decision Tree online today to determine your tax residency status.

A nonresident alien is an alien who has not passed the green card test or the substantial presence test.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.