Loading

Get Tc-62pr

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TC-62PR online

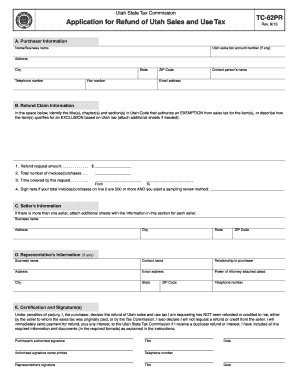

The TC-62PR form is the Application for Refund of Utah Sales and Use Tax. This guide will walk you through the process of filling out the form online, ensuring that you provide all necessary information for a successful refund application.

Follow the steps to complete your TC-62PR application.

- Click ‘Get Form’ button to access the TC-62PR online and open it for editing.

- In section A, enter your purchaser information. Fill in your name or the business name, sales tax account number (if applicable), address, city, state, telephone number, fax number, ZIP code, contact person's name, and email address.

- Move to section B labeled Refund Claim Information. Identify the relevant titles, chapters, and sections in Utah Code that authorize your exemption from sales tax or describe how your items qualify for exclusion based on Utah law. If needed, attach additional sheets.

- In section B, specify the refund request amount in the appropriate field. Indicate the total number of invoices or purchases related to your claim.

- Provide the time period covered by this request, specifying both the start and end dates.

- If you are requesting a refund amount based on 500 or more invoices, sign in the designated area to elect a sampling review method.

- In section C, fill out the Seller’s Information. If there are multiple sellers, ensure to attach additional sheets with similar details for each seller, including their business names, addresses, contact names, and relationships to the purchaser.

- If applicable, complete section D with the Representative’s Information, including details of any representative involved in the transaction.

- In section E, certify your application by signing and including your title and date. Ensure that your signature confirms that the refund has not been previously credited and that you will not request a duplicate.

- Review your completed TC-62PR for any missing information. Finally, choose to save changes, download, print, or share the form as needed.

Complete your TC-62PR application online today for a streamlined refund process.

Cox signed into law H.B. 54, which, retroactive to January 1, 2023, lowered the state's personal income tax rate from 4.85% to 4.65%. This is the second consecutive year that Utah has retroactively lowered the personal income tax rate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.