Loading

Get Form 8827

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8827 online

Filling out Form 8827 online can be a straightforward process when you have clear guidance. This document serves as a comprehensive resource to help you navigate through each section of the form effectively.

Follow the steps to complete the form with ease.

- Click the ‘Get Form’ button to access the form and open it in your online editor.

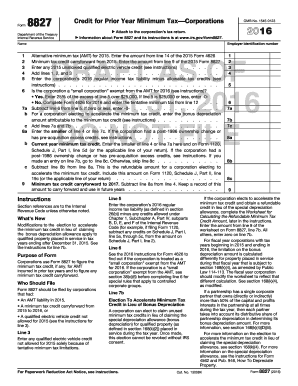

- Begin by entering the employer identification number and the name of the corporation at the top of the form.

- For line 1, input the alternative minimum tax amount from line 14 of the prior year's Form 4626.

- In line 2, enter the minimum tax credit carryforward from the previous year’s Form 8827.

- For line 3, if applicable, include any unallowed qualified electric vehicle credit from the previous year.

- Add lines 1, 2, and 3 together and enter the total in line 4.

- For line 5, denote the corporation's regular income tax liability for the current year, minus any allowable tax credits.

- In line 6, assess whether the corporation qualifies as a 'small corporation' exempt from AMT; enter the necessary calculations as instructed.

- Line 7 requires you to subtract line 6 from line 5; enter -0 if the result is zero or less.

- If the corporation chooses to accelerate the minimum tax credit, provide the bonus depreciation amount on line 7b.

- Complete line 8a by entering the smaller of line 4 or the sum of lines 7a and 7b.

- For line 9, carry forward the remaining minimum tax credit to apply in future years as instructed.

- Once all fields are completed and verified for accuracy, you can save changes, download, print, or share the form as needed.

Start completing your Form 8827 online today for a seamless filing experience.

Purpose of Form Use Form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (AMT) you incurred in prior tax years and to figure any credit carryforward to 2020.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.