Loading

Get Sba Form 994f Application For Surety Bond Guarantee ... - Sba.gov - Sba

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SBA Form 994F Application For Surety Bond Guarantee

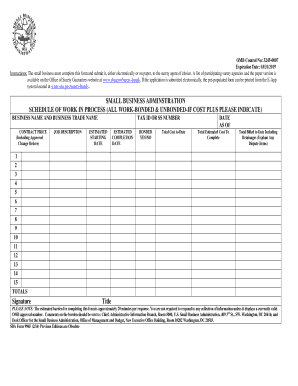

Filling out the SBA Form 994F Application For Surety Bond Guarantee is an essential step for businesses seeking surety bonds. This guide will walk you through each section of the form, ensuring you provide the necessary information accurately and efficiently.

Follow the steps to complete the SBA Form 994F smoothly.

- Click ‘Get Form’ button to access the SBA Form 994F and open it for editing.

- In the form, locate the 'Business Name and Business Trade Name' field and enter the legal name of your business along with any trade names you are using.

- Next, fill in the 'Contract Price' field, ensuring to include any approved change orders in this amount.

- Provide a detailed 'Job Description' that clearly outlines the scope of work for which you are applying for the surety bond.

- Enter your 'Tax ID or SS Number' for identification purposes.

- Indicate the 'Estimated Starting Date' of the project, specifying when you plan to begin work.

- Fill in the 'Estimated Completion Date' to project when the work will be finished.

- In the field labeled 'Bonded Yes/No', specify whether the work is bonded.

- Complete the 'Total Cost to Date' and ensure the figures are accurate as of your most recent accounting.

- Provide the 'Total Estimated Cost To Complete' the project based on your current calculations.

- Fill out the 'Total Billed to Date Including Retainages' and explain any disputed items if applicable.

- Sign the form in the 'Signature' field and provide your title to validate the application.

- Review the completed form for accuracy, saving any changes.

- Once finalized, download, print, or share the form as needed.

Complete your SBA Form 994F online today to streamline your surety bond application process.

A surety bond can be used to describe all types of instruments, but in general "surety" means that it shows an agreement or contract. Performance bonds are specific types of these agreements with pre-planned outcomes already included within them.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.