Loading

Get P11dws3 (2014) Vans Available For Private Use 2013-14 - Hmrc Gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the P11DWS3 (2014) Vans Available For Private Use 2013-14 - Hmrc Gov online

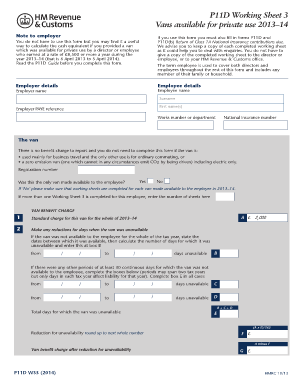

The P11DWS3 (2014) form is essential for employers reporting vans made available for private use by employees. This guide provides step-by-step instructions to assist users in accurately completing the form online.

Follow the steps to effectively complete the form.

- To begin, press the ‘Get Form’ button to obtain the P11DWS3 (2014) form and open it in your preferred online document editor.

- Fill in the employer details section, including the employer name, employer PAYE reference, and any other required identification information.

- Next, provide the employee details with their full name (surname and first name(s)), work number or department, and National Insurance number.

- In the section regarding the van, determine if there is a benefit charge to report. If the van is primarily for business use with ordinary commuting as the only other use, you do not need to complete the form. Mark the van registration number as applicable.

- Answer whether this is the only van made available to the employee. If not, ensure to complete a working sheet for each additional van provided during the tax year.

- Calculate the standard charge for the van for the entirety of the tax year in the designated box, considering any necessary reductions for days the van was unavailable.

- Document the total number of days the van was unavailable and any relevant dates during which the van was provided to the employee.

- If the van was shared with other employees, indicate the percentage reduction for sharing and provide an explanation for the basis of this reduction.

- Calculate any payments made by the employee for private use of the van and ensure to include this in the final value of the van benefit charge.

- Review all filled information for accuracy, and proceed to save changes, download, print, or share the completed form as needed.

Complete the P11DWS3 (2014) form online to ensure compliance and accurate reporting.

If an employer allows you to use a company car for personal use, it is considered to be a non-cash fringe benefit. The Internal Revenue Service (IRS) will treat this as taxable compensation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.