Loading

Get Form J

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form J online

Filling out Form J online can be a straightforward process when you have a clear understanding of each section. This guide provides step-by-step instructions to help users, regardless of their legal background, navigate the form effectively.

Follow the steps to successfully complete the Form J.

- Press the 'Get Form' button to access the Form J. This will allow you to open the form in an online editor where you can start filling it out.

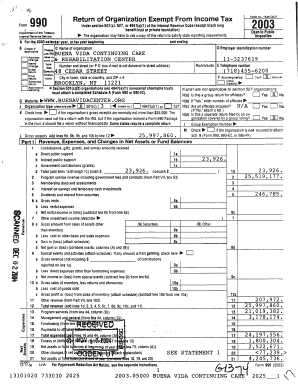

- Begin with section A by entering the year applicable for the form, as well as the organization's employer identification number. Ensure you check if the organization is required to file a report for state purposes.

- In section C, provide the name of the organization and its address. Verify that the contact details are accurate for future correspondence.

- Complete section D, which requires you to select the accounting method used by the organization—either cash or accrual. Make sure to select the correct method.

- Proceed to sections H(a) through H(d) to answer questions regarding whether this is a group return, if all affiliates are included, and if the organization’s gross receipts are below a specified threshold.

- In part I, accurately enter revenues, including contributions and grants received, as well as any program service revenue. Be thorough in reporting all applicable amounts.

- Continue with expenses in part II. Itemize all expenses, ensuring clarity and accuracy for each entry. Attach any necessary supporting schedules if required.

- Review part III to describe the organization's exempt purpose achievements. This section should be concise yet sufficiently detailed to portray the impact of your organization’s efforts.

- Complete the balance sheet in part IV, detailing both assets and liabilities at the beginning and end of the year. Ensure that the totals are balanced.

- Finally, once all sections are accurately filled out, save your changes, then download, print, or share the Form J as needed.

Start your journey in managing documents online by completing your Form J today.

Income averaging was a tax break that assisted people with large income deviations up until 1986. After the 1986 Tax Reform Act, income averaging was eliminated for everyone except fishermen and farmers.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.