Loading

Get 2015 M1pr, Property Tax Refund Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

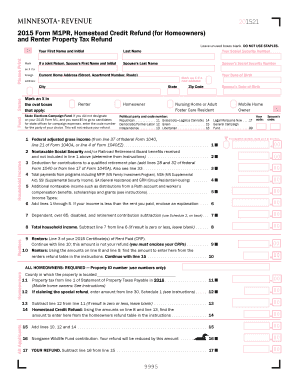

How to fill out the 2015 M1PR, Property Tax Refund Return online

This guide provides a concise overview on how to accurately complete the 2015 M1PR, Property Tax Refund Return online. By following these steps, users can ensure that their forms are filled out correctly and submitted successfully.

Follow the steps to effectively fill out the form.

- Click ‘Get Form’ button to access the 2015 M1PR document and open it for editing.

- Provide your first name, middle initial, last name, and Social Security number in the designated fields. If you are filing jointly, include your spouse’s information accordingly.

- Enter your current home address, including street, apartment number, city, state, and zip code. Include your date of birth and your spouse’s date of birth if applicable.

- Indicate your household income status by marking the relevant checkboxes for homeowners or renters. If you have a negative number, mark the corresponding box.

- Fill in your federal adjusted gross income from the required federal tax form, and proceed to input nontaxable income amounts, deductions, and other specified income as per the form instructions.

- Complete the sections related to property taxes paid, any special refund amounts, and household income calculations. Review the instructions closely if any line items refer to previous tax forms or benefit programs.

- For those claiming a property tax refund, fill in the necessary information regarding property tax, including the property ID number and tax amount from your statement.

- Follow through the required calculations as indicated on the form, ensuring all appropriate lines are completed accurately to arrive at your potential refund amount.

- Finalize your submission by reviewing all entries for accuracy. Save your changes, download or print a copy of the completed form, and prepare for submission.

Start filling out your property tax refund return online for a smooth filing experience.

You spent at least 183 days in Minnesota during the year. You cannot be claimed as a dependent on someone else's tax return. Your property was assessed property taxes or the owner made payments in lieu of property taxes. Your household income is below a certain amount.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.