Loading

Get Work Mileage Tracker Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Work Mileage Tracker Form online

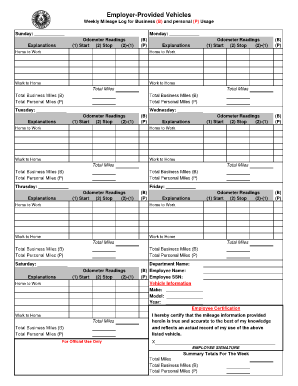

This guide provides a step-by-step overview of how to effectively fill out the Work Mileage Tracker Form online. Whether you are tracking business or personal mileage, these instructions will help ensure accuracy and compliance.

Follow the steps to complete your mileage tracking form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering the daily mileage for each day of the week in the corresponding fields. Record the odometer readings by noting the start and stop mileage.

- In the explanations section for each day, specify the purpose of the trips, tagging them as business (B) or personal (P) usage.

- Continue to fill out the daily sections, ensuring to record the total miles and to classify them accurately as total business miles (B) and total personal miles (P).

- At the end of the week, calculate the summary totals for total miles, total business miles (B), and total personal miles (P).

- Input vehicle information including make, model, and year, ensuring all details are accurate.

- At the bottom, provide your certification by signing digitally to confirm that the mileage information is accurate and reflects actual usage.

- After completing the form, save your changes. You may then download, print, or share the form as needed.

Complete your Work Mileage Tracker Form online today for accurate mileage tracking.

ing to the IRS, you must include the following in your mileage log template: The mileage driven for each business-related trip. The date of each trip. The destination and purpose of your trip. The total mileage you've driven for the year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.